|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Best Interest Rate Mortgage Lenders: A Comprehensive GuideChoosing the right mortgage lender is crucial for securing the best interest rates. This guide explores the top lenders, offering insights into what makes them stand out and factors to consider when selecting one. Understanding Mortgage LendersMortgage lenders come in various types, each offering distinct advantages. It's essential to understand these differences to make an informed decision. Types of Mortgage Lenders

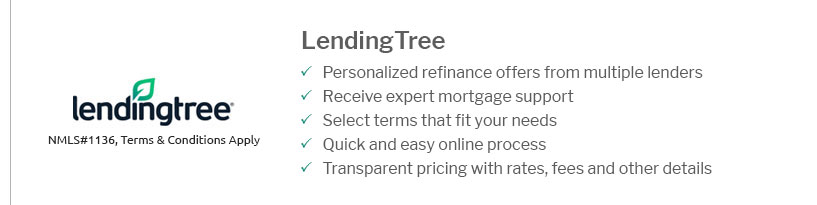

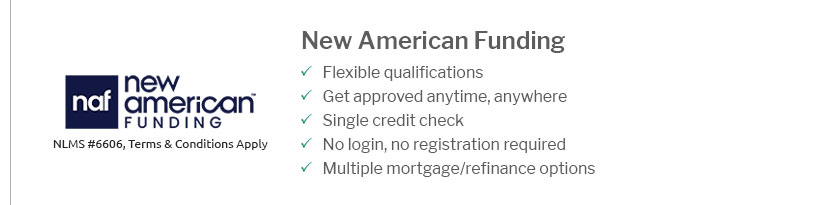

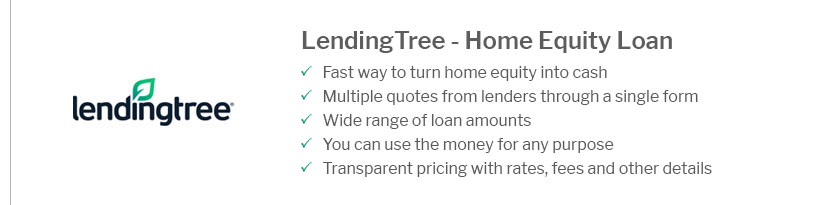

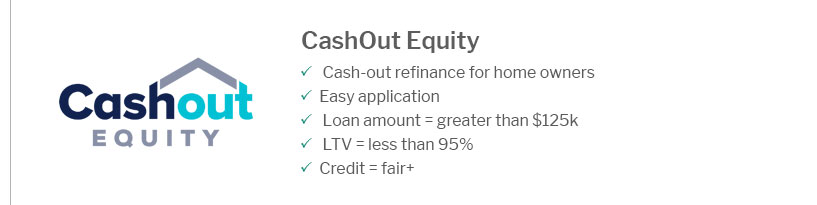

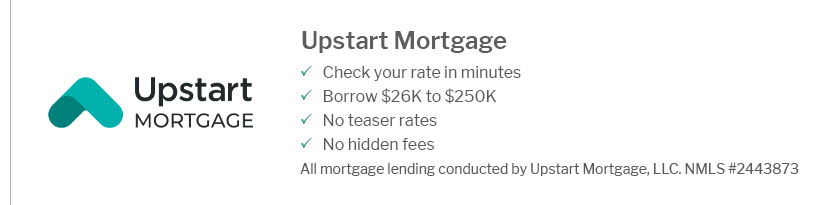

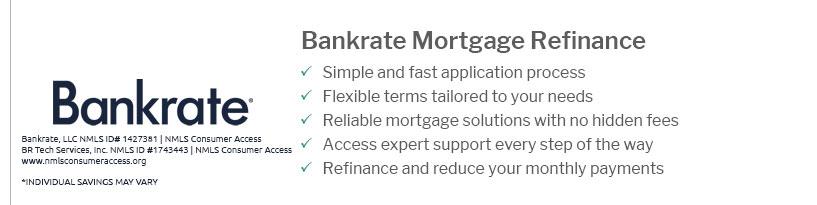

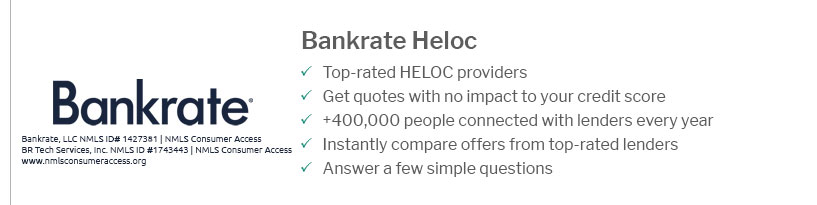

Top Lenders for Best Interest RatesHere are some of the leading mortgage lenders known for offering competitive interest rates:

When exploring mortgage rates today hawaii, it's beneficial to compare these options based on your specific needs. Factors to ConsiderWhen selecting a mortgage lender, it's crucial to consider several factors to ensure you get the best deal. Interest RatesLook for lenders that offer the most competitive interest rates. Even a slight difference can lead to significant savings over the loan term. Fees and ChargesExamine all associated fees, including origination fees, closing costs, and any potential penalties. Some lenders might offer lower rates but higher fees. Customer ServiceExcellent customer service can make the mortgage process smoother. Read reviews and ask for recommendations to gauge customer satisfaction. Loan OptionsDiversified loan options, such as fha programs near me, can provide flexibility based on your financial situation and future goals. FAQWhat is the best way to compare mortgage lenders?The best way to compare mortgage lenders is to look at their interest rates, fees, loan options, and customer reviews. Using online comparison tools can also provide a quick overview of the available rates and services. How do interest rates affect my mortgage?Interest rates significantly impact the overall cost of your mortgage. A lower interest rate can reduce your monthly payments and decrease the total amount paid over the life of the loan. Can I negotiate mortgage rates with lenders?Yes, negotiating with lenders can sometimes result in better rates. It helps to have a strong credit score and to present offers from other lenders as leverage during negotiations. In conclusion, selecting the best interest rate mortgage lender involves careful consideration of various factors. By doing thorough research and comparing your options, you can find a lender that meets your needs and secures your financial future. https://www.marketwatch.com/picks/this-is-the-most-recommended-mortgage-lender-in-america-665c73ef

Here's what 9 major financial sites in America say the best mortgage providers are right now - Rocket Mortgage - Guaranteed Rate - PNC Bank - Ally ... https://www.nerdwallet.com/h/category/mortgages

... Buying a home - Selling your home. Getting started with a mortgage lender. Best Mortgage Lenders. by Dawnielle Robinson-Walker - Current Mortgage Interest Rates. https://www.reddit.com/r/Mortgages/comments/1ihrtnm/best_lendersbanks_for_low_mortgage_interest_rates/

Online lenders like Rocket and Better will draw you in with low rates, but the process usually isn't great.

|

|---|